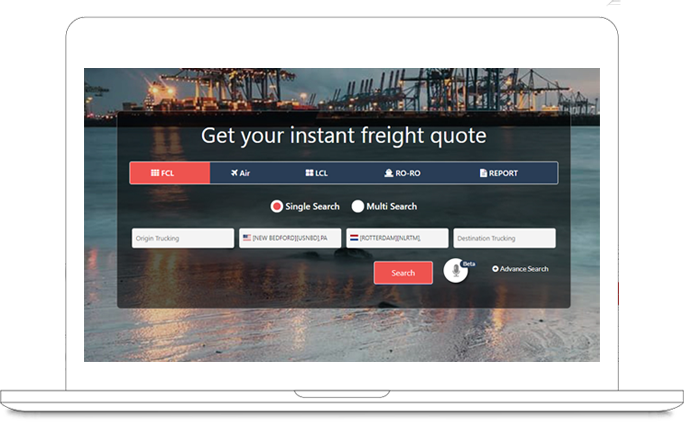

AMS Filing for

U.S. Imports

Accurate, On-Time, CBP-Compliant

File Automated Manifest System (AMS) accurately and on time — ensure CBP compliance for ocean shipments, avoid penalties, and keep your imports moving without delays.

Why AMS Filing Is Critical for

Why AMS Filing Is Critical for